The modified accelerated cost recovery system macrs is used to recover the basis of most business and investment property placed in service after 1986.

Macrs life carpet.

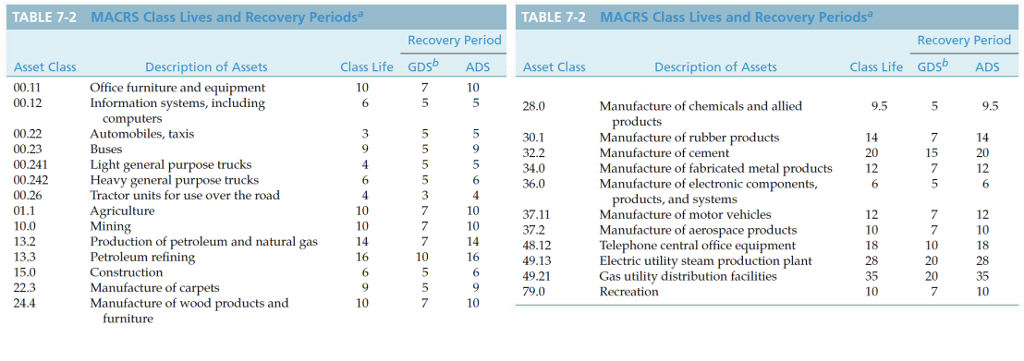

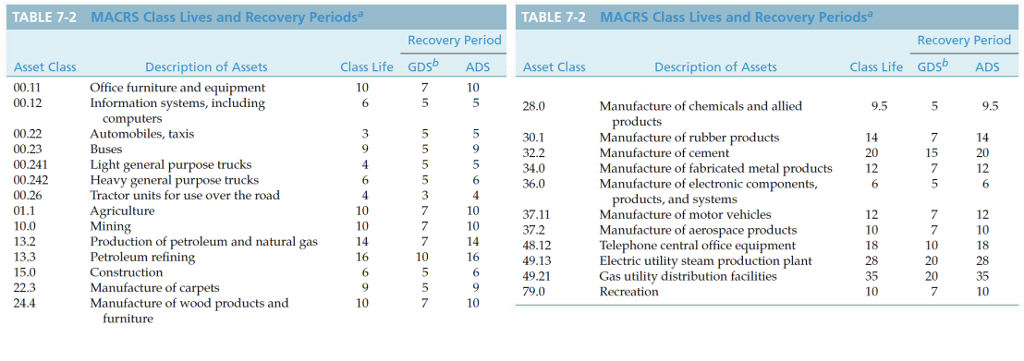

Each item of property that can be depreciated under macrs is assigned to a property class determined by its class life.

Macrs consists of two depreciation systems the general depreciation system gds and the alternative depreciation system ads.

Thus if the class life of carpet e g is more than 4 but less than 10 years the landlord depreciates carpet over 5 years because it is 5 year property.

Macrs depreciation schedules are only used for income tax reporting not financial reporting.

See irs publication 5271.

The macrs asset life table is derived from revenue procedure 87 56 1987 2 cb 674.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

Macrs aims to maximize deductions using accelerated depreciation schedules to encourage capital investments not to accurately reflect the use of the asset over its useful life on the financial statements.

Beyond that distinction depreciating carpeting is the same as depreciating a new appliance see the more detailed appliance depreciation article above.